IF FINANCE FOCUSES DECISIONALLY ON RENEWABLES

By Eladio PASCUAL – Director of Audax Renovables Operations

“We believe that sustainability should be our new standard for investing” or if you prefer in the Italian translation “We believe sustainability should be our new investment standard”.

That traditional finance looks with interest at renewables - as an opportunity, certainly - was made clear by Larry Fink, CEO of BlackRock, the largest fund manager in the world. In the usual letter He went further to investors, saying the company would remove from its portfolio stocks and bonds of companies that earn more than 25% of their profits from coal production.

The road seems to be marked. We are talking about the now solid link between the financial world and renewable sources. Data from recent years indicates how investors are increasingly orienting themselves towards the world of energy green. Well before, therefore, that the climate change rose to an issue of primary importance and a source of concern for global public opinions and - consequently - was rightfully included in the agendas of the respective governments.

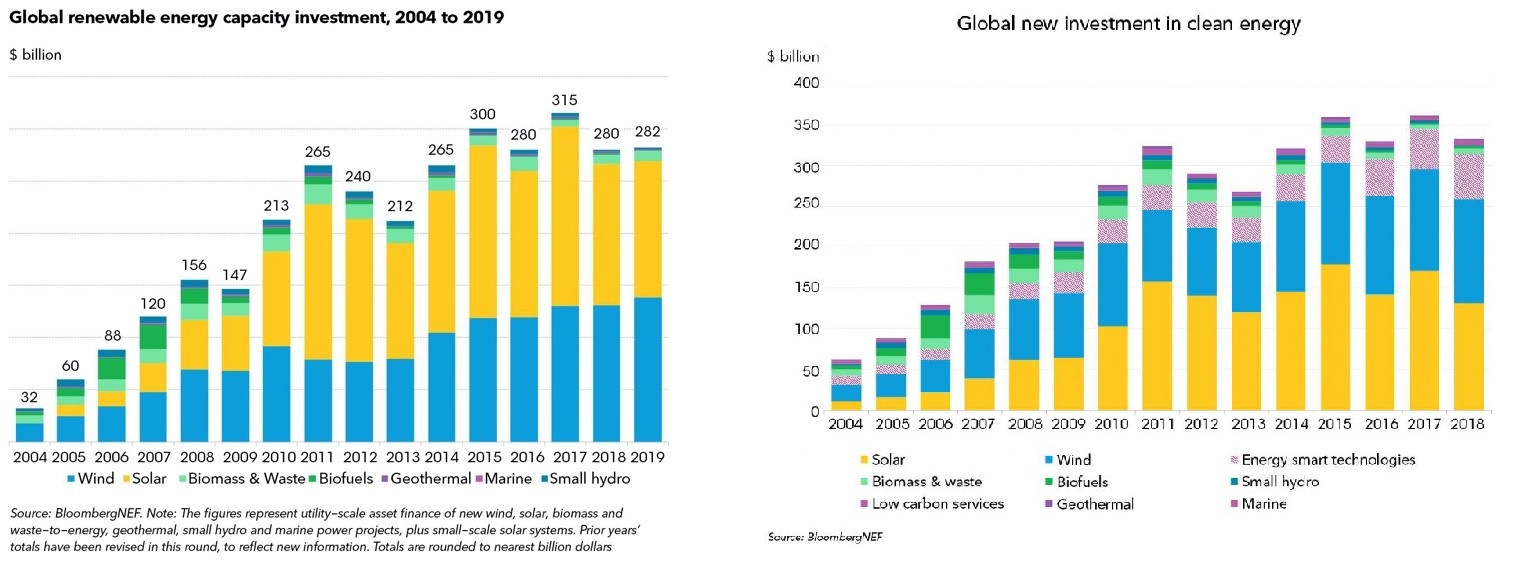

Let's see some data. The figures provided by Bloomberg New Energy Finance on the quantity of investments dedicated to renewable energy alone, show how in 2019 they reached 282 billion dollars, with +1% compared to 2018. The figure discounted some critical issues in the photovoltaic sector, due in particular to the strong contraction in the Chinese market. However, it should not be forgotten that, in 2017, the figure was very good, with 315 billion dollars invested, as well as in 2015 with the achievement - for the first time - of 300.

And over 300 was the estimate made by analysts for this 2020, before Covid-19 made its appearance, upsetting what had been predicted.

In any case, going beyond this troubled and exceptional first half of 2020, and imagining a return to normality, it is very likely that investments will start to rise again.

In fact, observing the graphs relating to the period 2004-2019, we can see how the curve, beyond some limited declines, has always pointed upwards. To give the dimensions of the growth it is sufficient to consider the starting point: 32 billion invested 16 years ago versus, precisely, 282 today.

If we then examine the data which, in addition to renewable energy, also includes the so-called "energy and smart technologies" and "Low carbon services", the figure not only exceeds 300 billion but has done so continuously since 2014.

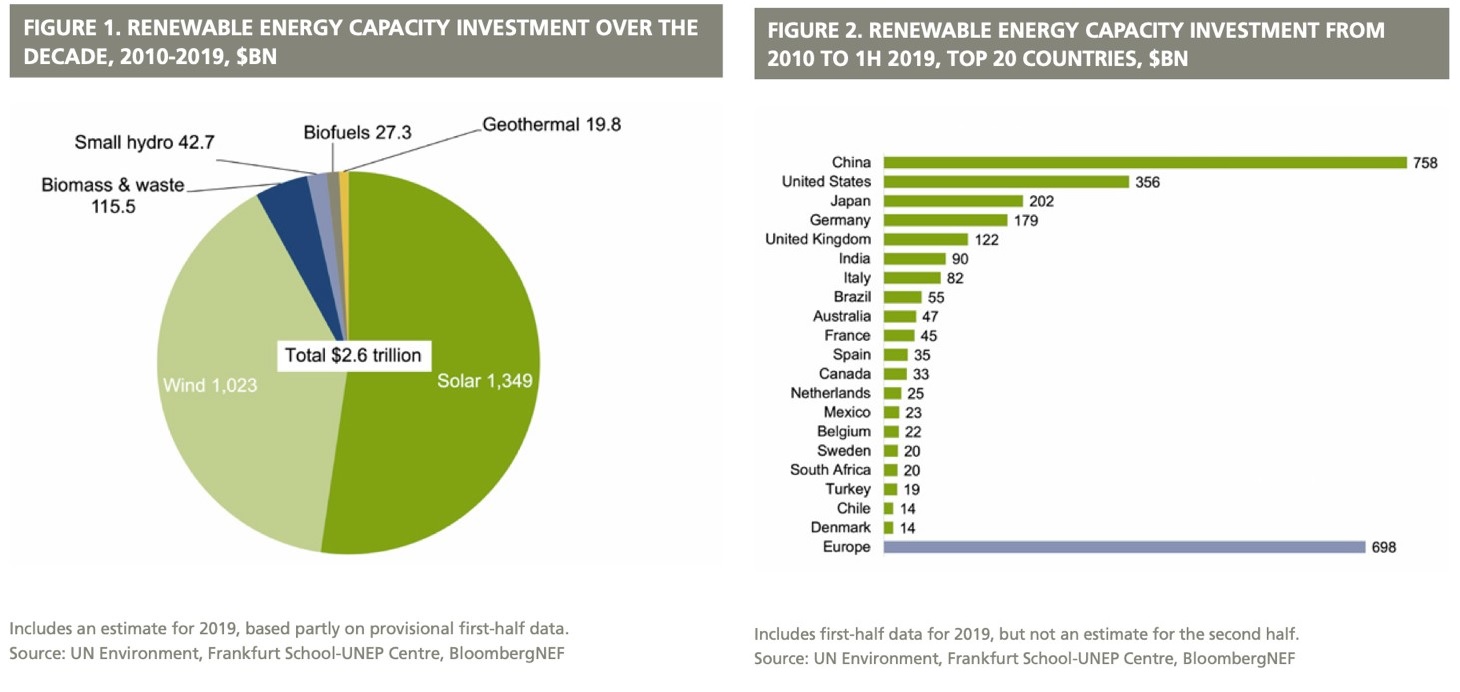

Important numbers also emerge from Global Trends in Renewable Energy Investment 2019, commissionato dall’UNEP, il Programma delle Nazioni Unite per l’ambiente. Nell’arco di un decennio le rinnovabili hanno oltrepassato i 2.600 miliardi di dollari di investimenti.

Leading the list of countries that have invested the most in RES is China, with over 750 billion dollars. The United States follows at a distance with 350 and Japan with 200. Europe as a whole reaches almost 700 billion; Italy occupies seventh position with 82 billion, while Spain is eleventh, with 35.

Nel solo 2018, l’investimento in FER ha superato i 270 miliardi di dollari, tre volte tanto rispetto a quello messo per la produzione di combustibili fossili.

The solar data is interesting, whose capacity following these 10 years of investments has increased 26 times, going from 25 Gw in 2009 to 663 in 2019. To be clear, the sufficient quantity to be able to produce the electricity necessary to power approximately 100 million US families.

In 2018, 29 countries joined the "club" of those who have invested more than 1 billion in renewable energy projects. An increase in number, given that there were 25 in 2017 and 21 in 2016.

Among those attracted by the RES business there are also countries, such as those in the Gulf, which have lived and - in all likelihood - will continue to live on oil and hydrocarbons for the next decades. At least until the energy transition is in a more advanced stage.

The reason for this interest - not new, but which has intensified in recent times - is twofold: investing in a growing market to obtain good profits and strategically guaranteeing an energy future when the right time arrives. From the Renewable Energy Market Analysis: Gcc 2019, carried out by the International Renewable Energy Agency (IRENA), shows that Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates, by exploiting renewables, would save 354 million barrels of oil equivalent (-23%), equal to 46-76 billion dollars. A result which, in addition to the economic side, will have positive repercussions on the environmental one - 22% of carbon emissions avoided and less than 17% of water used - and on the social one due to the number of jobs created.

If investing is important, attracting investments is equally important. L'Italy is placed at 17th place for attractiveness, according to the 54th edition of EY study”Renewable Energy Country Attractiveness Index” (Recai), which ranks the best 40 countries in the world based on development opportunities in the renewables sector. This is a leap forward of one position compared to 2018; the same goes for Spain, which rose to 15th place (it was 16th). At the top are China, the United States and India which takes the place of France, which dropped to 4th.

From this year onwards, with the adoption of the National Integrated Plan for Energy and Climate - more simply PNIEC – even in Italy it will be possible to use financial instruments such as i PPA (Power Purchase Agreement), fundamental for promoting and facilitating investments in the field of renewables, especially solar photovoltaic. And the Audax Group on this front was among the pioneers in the use of these tools, both in Spain and in Italy.

In short, the road, as we said at the beginning, is now marked.