GAS, BETWEEN ENERGY TRANSITION AND GEOPOLITICAL ASPECTS

di Jonathan García Gaitan – Director Operaciones Gas

Il recente attacco a due petroliere nello stretto di Hormuz – la lingua di terra che divide la penisola arabica dall’Iran – ha messo in allarme il mondo oltre che per le possibili ripercussioni politiche (nei rapporti tra USA, Iran e Paesi del Golfo) anche per le conseguenze sul commercio di idrocarburi. Nello specifico, si è temuto un innalzamento del prezzo del GNL (il gas naturale liquefatto) che in grande quantità transita per lo stretto, trasportato dalle navi provenienti dal Qatar. In caso di turbolenze politiche, è probabile un deciso aumento dei prezzi, come fanno supporre le schermaglie diplomatiche fra Stati Uniti e Iran di queste settimane. Le conseguenze più gravi le subiranno quelle nazioni importatrici poco indipendenti da un punto di vista energetico, tra le quali c’è l’Italia.

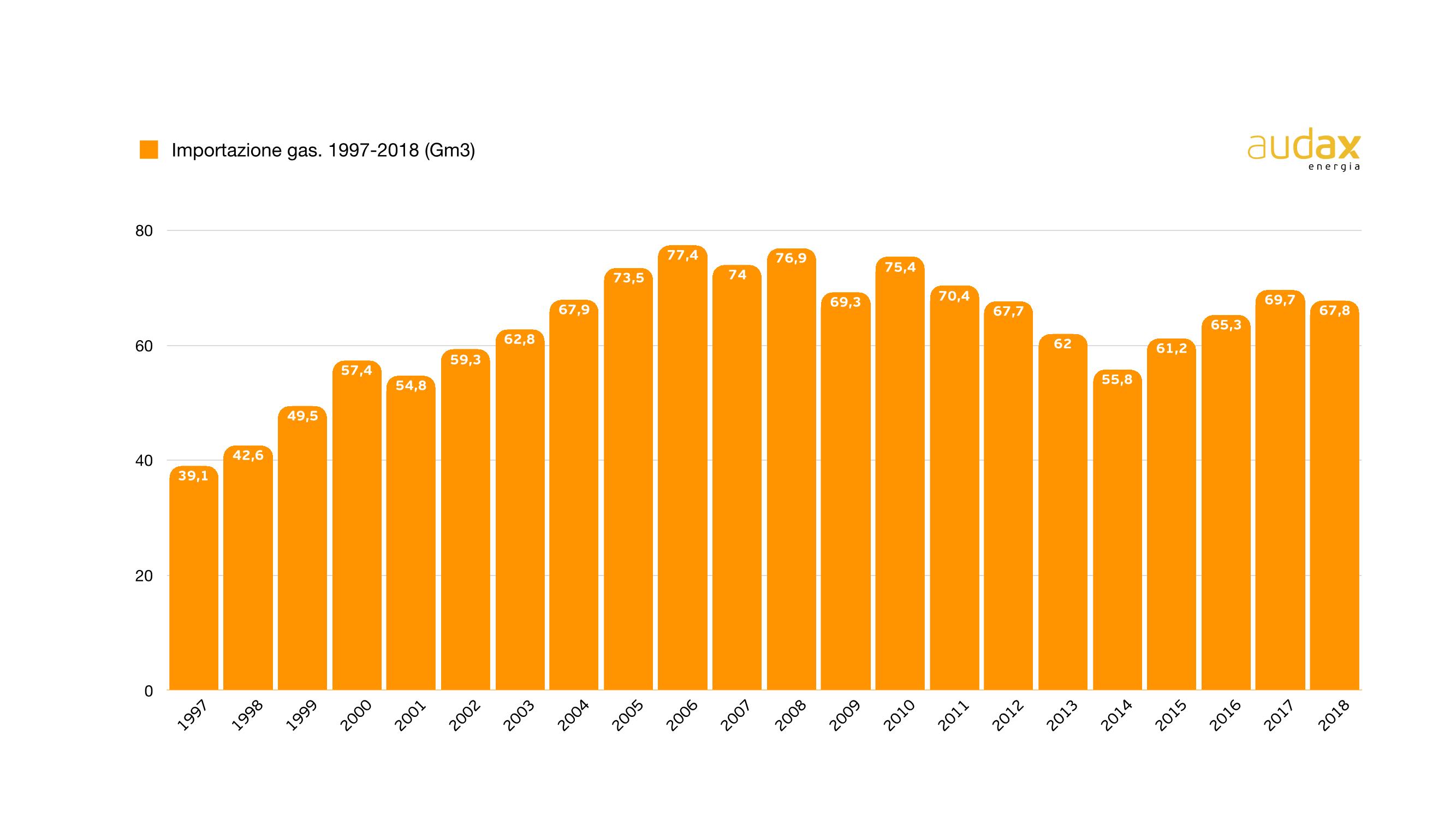

And Italy's energy dependence on other states does not spare - as can be imagined - even natural and liquefied gas. In 2018, in fact, 67 billion cubic meters of gas were imported, with a decrease of 2.6 billion compared to 2017.

Arriving almost entirely via pipeline (over 90%), the gas used in Italy is 44% of Russian origin (with 29.5 billion cubic metres); it is followed by the Algerian one (25%), with 17.1 billion m3 - but rather downsized after the 2016 exploit - that of Northern Europe (Norway and Holland) and that from Libya. However, if imports from Northern European countries show a positive sign (+7% in 2018), Libyan imports, also due to the internal difficulties of the African nation, continue to decrease (4.4 billion m3).

With the entry into operation of the Trans Adriatic Pipeline (TAP), scheduled for 2020, the quotas could change and help lower the cost of gas for Italian consumers. In Italy, end customers pay on average 10% more for gas than in Northern European countries.

The expected transport capacity will be approximately 10 billion m3, with the possibility of satisfying the needs of 7 million families.

LNG continues its growth, currently representing 7% of imported gas.

Graph 1. Gas import. 1997-2018 (Gm3)

Source: ARERA on MISE DGSaie data

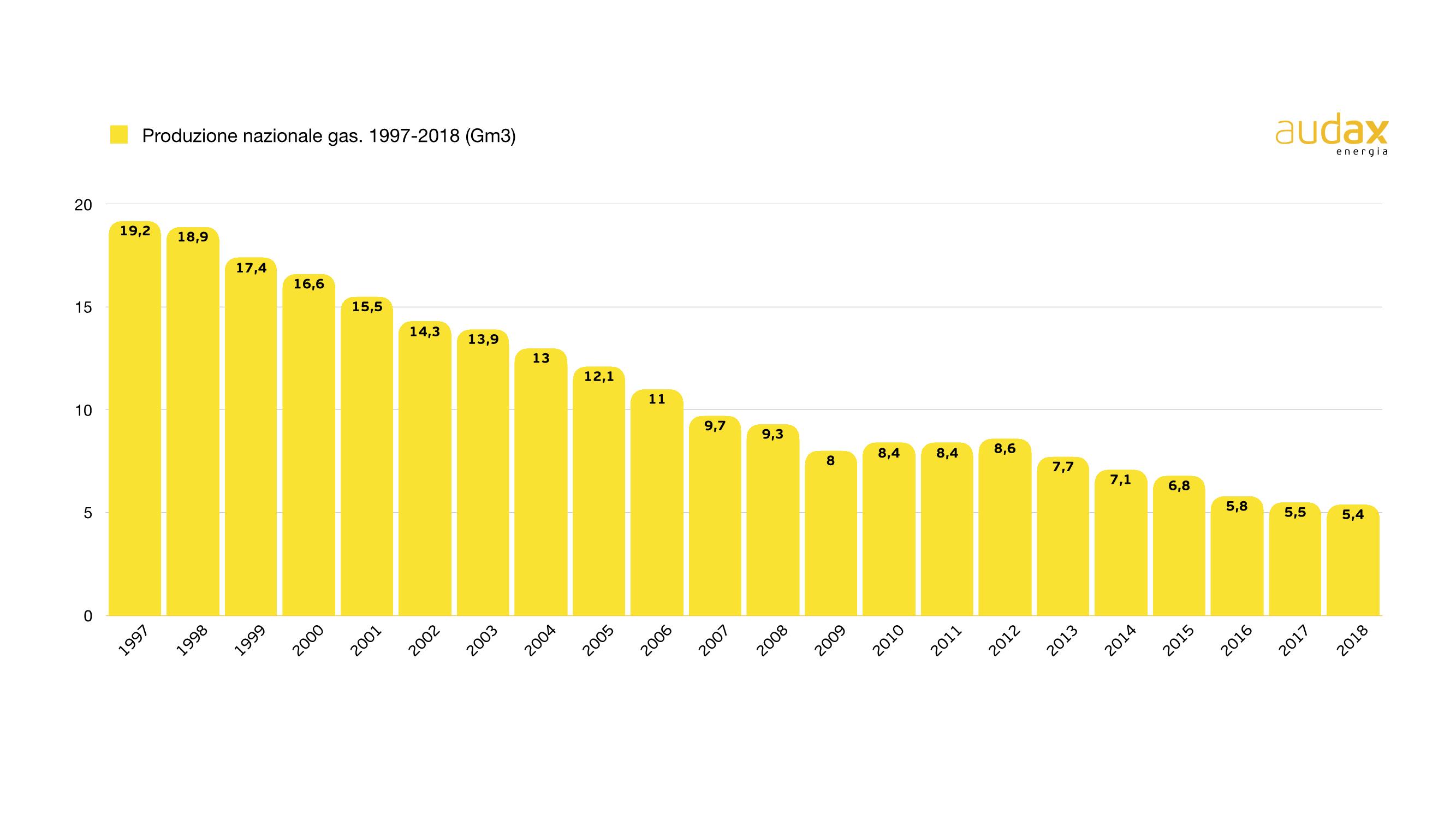

And what about internal production? After years, 2018 showed a less significant decline compared to the past (-1.6%); within 10 years, however, Italian production halved, going from 9.3 billion cubic meters in 2008 to just over 5.4 billion last year.

Graph 2. National gas production. 1997-2018 (Gm3)

Source: ARERA on MISE DGSaie data

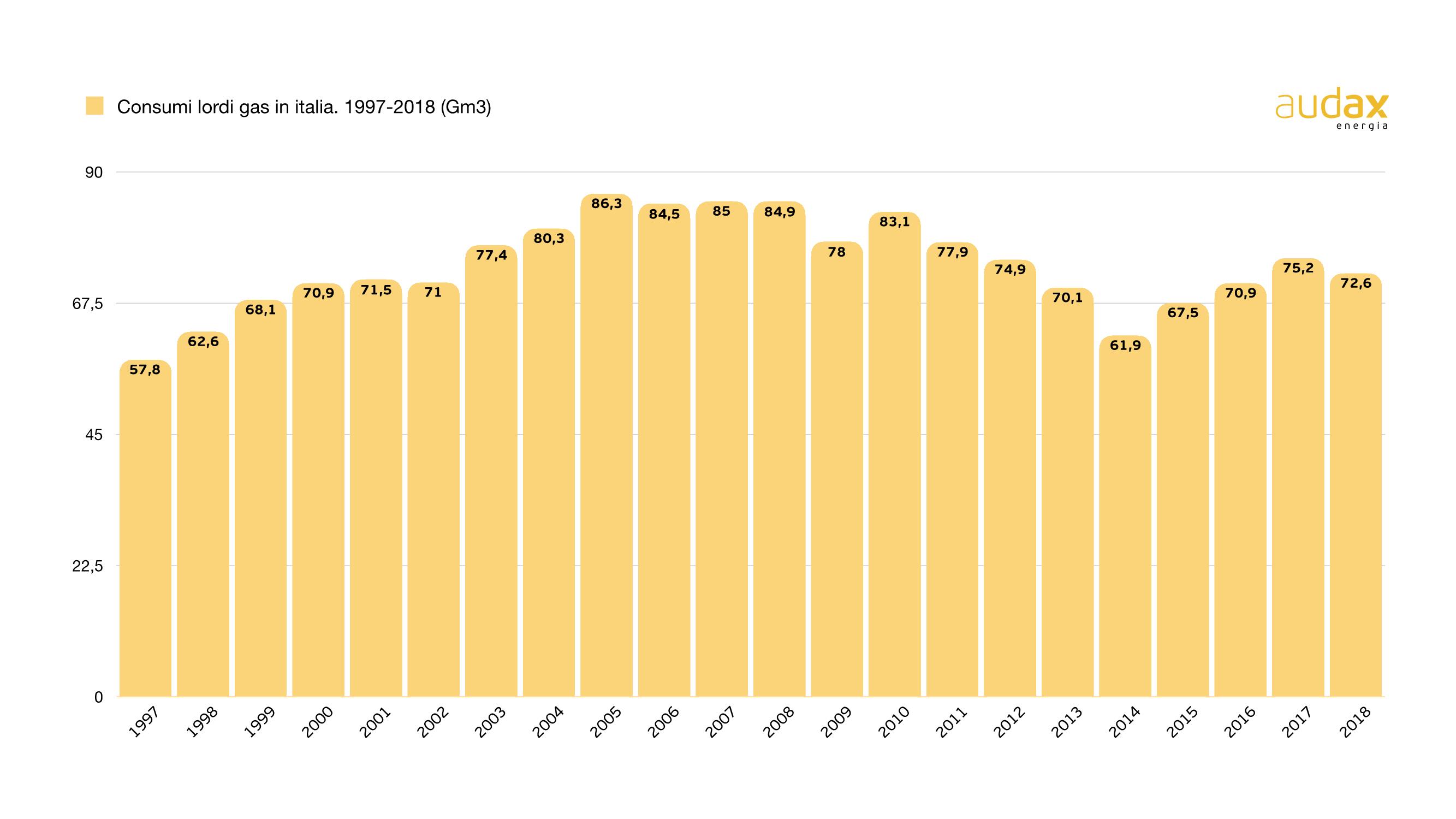

Regarding consumption, in 2018 they reached 72.6 billion m3, down by 3.3% compared to the previous year. Complicit in the decrease was the lower demand for thermoelectric energy, the gas used to produce electricity. A minus 7.6% essentially due to three factors such as: a greater contribution from renewables, more energy coming from hydroelectric, more nuclear power purchased in France.

In any case, we are still below the consumption levels of 2003, when over 86 billion cubic meters were consumed (source MiSE-DGSAIE)

Gross gas consumption in Italy. 1997-2018 (Gm3)

Source: ARERA on MISE DGSaie data

Without having overshadowed the role played by its big brother - oil - gas has transformed into an important strategic lever to be used in political and economic relations between states. Referred to as the fuel of the energy transition, it has become - for some time now - a sensitive thermometer of the geopolitical situation. And he is evidently conditioned by this. But not only that, elements such as climatic conditions - for example cold winters or springs that are slow to appear - can negatively impact the price.

In any case, the "macro" affects the "micro", which means repercussions on prices not only wholesale, but also on the bill. The Energy Observatory of the Facile.it portal, analyzing over 63 thousand contracts collected during 2018, estimated that if electricity accounted for 417 euros/year on the expenditure of an average Italian family, gas has come to affect for 762 euros.

Da un punto di vista prospettico, gli outlook delle organizzazioni internazionali (come IEA) o i centri studi dei grandi gruppi (come BP) provano a stimare l’andamento dei prezzi nei prossimi anni. Le previsioni parlano di un innalzamento a lungo termine del costo del gas naturale in Asia, complice l’aumento della domanda, le politiche antinquinamento e la costruzione di nuove infrastrutture di trasporto. Nello stesso tempo, in Europa vi sarà una forte pressione sui prezzi dovuta – oltre alle scelte di mitigazione della CO2 – alla concorrenza tra i consumatori europei e asiatici.

In all of this, future scenarios show a global demand for natural gas increasing by 46%, at least until 2040. Also following a progressive reduction in the shares currently occupied by oil (from 32% to 29% by 2040) and coal ( from 27% to 21%).

In conclusione, uno sguardo alla sola Cina. Il Paese asiatico rappresenta il 37% dell’aumento globale del consumo di gas naturale tra il 2017 e il 2023: nessuno più di Pechino. Il bisogno crescente, la porterà entro quest’anno a essere la più grande nazione importatrice di gas naturale del mondo e, con 171 miliardi di metri cubi entro il 2023, una delle più servite da GNL. Il settore trainante sarà quello dell’industria, responsabile di oltre il 40% dell’aumento del consumo di gas naturale.

Sources:

- ARERA, Statistics

- Gas Exporting Countries Forum (GECF), 2018 Global Gas Outlook Synopsis

- International Energy Agency (IEA), GAS 2018. Analysis and Forecast to 2013 (executive summary)

- BP, Energy Outlook 2019